This is probably the scariest post I have ever written. I will gladly spill my emotions out without hesitation, but our society teaches us that money is a BIG secret. Asking “how much do you make?” is considered a rude question. God forbid you ask someone how much they paid for their car (but then we Google the MSRP and make some guesses on that monthly payment). However, a way to TRULY help each other is to talk about this stuff.

A few months ago I was writing in my Instastory about finances. We had recently become debt free and people were asking how we did it. I took a poll and asked how many would love to see an example of our budget and 100% of the responses were yes….and there were DOZENS of people.

I felt like I had opened the door and had to follow through, but I put it off for months. It felt vulnerable and scary.

My husband is in the film industry so with all the shoots cancelling during the pandemic we knew it was only a matter of time before his pay stopped. And then we got “the call.” After April, his income sources will dry up and we will be applying for unemployment. I know other people are facing similar situations, so I felt that it was finally time to open the window.

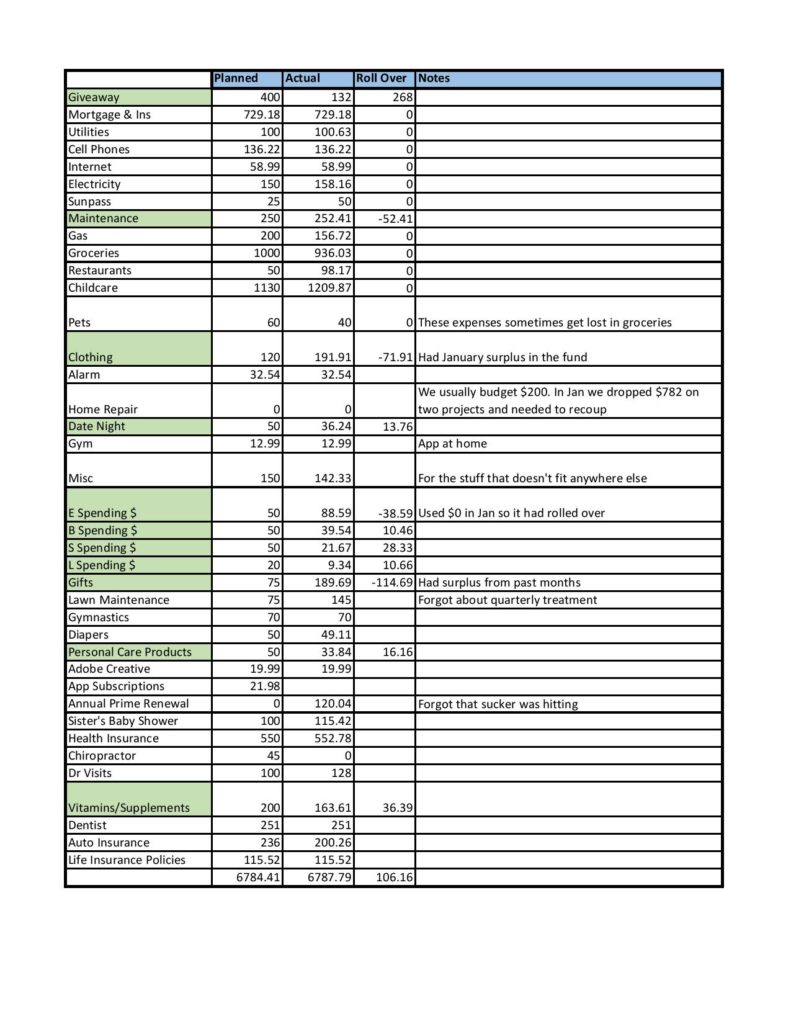

The reason I am choosing to take a GIANT risk, do something that feels VERY vulnerable, is because I am here to help people. I know so many people are facing financial challenges like us and talking about this stuff helps. Finding out what others spend on groceries, and life expenses helps us learn. So, I am going to share with you guys our February budget, which was a pretty normal month for us. Our May budget is being slashed by childcare and any other expenses we can trim to try our hardest not to tap into our emergency fund.

Important notes about reading this document:

- I don’t run our budget off an excel document. This was just the easiest way to publish the data. We use an app called Everydollar that organizes it all for us very well. My two favorite features are the drag and drop syncing feature with our bank, so after I swipe I just have to drag to the appropriate category, and the ability to establish funds.

- The green boxes are funds. Our app allows us set these up differently so that if we don’t spend all the money we budgeted for that category it will roll over to the next month. A great example of this is the car maintenance. We budget $250/month. Most months we will spend $0-50 on our cars and then have a $500-1000 repair a couple times a year. Setting aside the money each month anticipating those hits takes all the stress out of the yoyo-ing.

- Any money we bring in beyond the expenses goes into the savings. We follow the Dave Ramsey baby steps. We are now debt free, but we have not finished funding our 3-6 months emergency fund. Full disclosure, since we just became debt free around Christmas time, we don’t even have 1 month of expenses saved yet.

Have any questions? I’ll gladly answer them! Please comment, reply or email me if this brings any value to you so I can feel better about totally laying out my personal life for everyone to see.

If you would like to receive an email whenever my blog updates, you can subscribe by putting your email address into the bottom of the page. When you do so, it will send you a free gift download that is a self assessment called the “Wheel of Life.”

****2021 Update***

Since the original post was published, I have switched platforms. We now use You Need a Budget (YNAB) to manage our finances on a daily basis.

My greatest recommendation is that you create a budget and find a system that word for you to monitor it daily. Using a budget to let you know how much money you can afford to spend in a category will serve you much greater than just pulling up your checking account to see if you can “afford it.” It’s all about the budget.

This is great! Thanks for sharing.

Question: So if you are $3 over budget this month with $106 rolling over, does that mean you take the $3 out of savings?

The app I use, Everydollar, tracks it for me. I always have some buffer in my checking account so that I don’t have to stress over little things like that. Most months I’m up one area and down in another and it evens out. But I keep some extra cushion in my checking so I don’t have to sweat the small stuff.

This is amazing! Thank you for sharing ❤️ Just downloaded EveryDollar ??

Awesome! You’re going to love it!